Surviving a Stock Market Correction

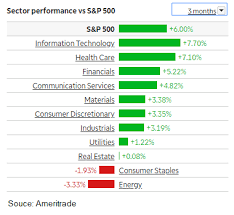

If you are a stock market trader, one of the things that you are going to experience at one time or another is a stock market correction. In case you don’t know what a stock market correction is, no worries, let us explain. A stock market correction is when a certain stock market index, such as the S&P 500, goes below 10% or more from its previous high.

Stock market correction came last anywhere from two to five months, although they can last longer. It is also true that the stock market correction can turn into a bear market. The issue is of course that during the stock market correction, making money is very difficult. This is what we are here to address today. We want to take a look at a variety of stock market trading techniques that can help you make money even during a stock market correction.

The fact of the matter is that during a stock market correction, you need to take various steps to ensure that you minimize risk while also increase your profit potential. The fact of the matter is that you can of course make money during a stock market correction, as long as you know what you are doing. Today, we are going to cover all of the different techniques on how to profit from the stock market correction.

Using a Stock Market Portfolio Defense Mechanism

If you expect to come out the other side of a market correction in one piece, you need to manage your risk. Most people would recommend not investing more than 10% of your portfolio into a single stock.

Therefore, if you have $5000 to spare, you should not invest more than $500 into a specific stock. You always also want to make sure that you have a stock whilst level that is 10% under your entry price.

Therefore, if you have a negative 10% stop loss combined with 10% portfolio allocation, if you lose a trade, you’re only risking 1%. That said, during the stock market correction, this can still be quite dangerous. Therefore, to get through a stock market correction, you only want to allocate 5% of your portfolio into a single trade.

:max_bytes(150000):strip_icc()/conservativeportfolio-tardi-d19760c073f44c5b94bf060071963751.jpg)

This will therefore allow you to have more trades open at once. When you allocate 10% of your portfolio into stocks, it means that you can have a maximum of 10 trades open. However if you allocate 5% into a single stock, then you can have 20 trades open at once.

Therefore, if you only allocate 5% into a single trade, and you lose a trade, you’re only risking 0.5% per trade. If you allocate 5% of your portfolio into a trade, and you have a negative 10% stop loss from the entry price, then you have a risk of just 0.5% per trade, with 20 trades open at once.

In order to survive the stock market correction, diversification is another thing that you want to consider. This does of course mean however that you need to be able to find the right kind of stocks to diversify with.

CLICK BELOW TO JOIN INCOME MENTOR BOX AND START MAKING REAL PROFITS!

Following Market Leaders

The principle of stock market diversification is as simple as not having all of your eggs in one basket, because if the basket drops, your eggs all break. Therefore, you need to know which eggs are the best ones to invest in. The fact of the matter is that everybody is going to give you an opinion, and those opinions are often going to be different.

You are the one making a final call here, so you’re the only one who makes the decision. The best way to find the best stocks to invest in during a market correction is by using a stock Screener. One good theory that you need to keep in mind is that when a price seems too high and risky to the majority of people, it will usually continue to go higher.

Yet, if the majority of people think that a price is too cheap and too low, it will then usually go even lower. You can therefore use a stock market Screener to see which stocks are the best ones to invest in during a market correction. Here you want to look at the rate of change as well as 52 week highs. Just make sure that all of the stocks fit your general trading plan and strategy, because you never want to stray too far away from that.

That Risk to Reward Ratio

During the market correction, another thing to keep in mind is your risk to reward ratio. Of course, you obviously want the lowest risk compared to the highest reward. There are three different things that you can do to assist with this. You can allocate very small, you can scale in and move your stop loss closer to the break even point, and you can also use a trailing stop loss.

As we have already talked about, you don’t want to allocate more than 5% of your trading portfolio into a trade during a market correction. However, you do need to identify the big movers, so you may want to invest another 5% into your stock position. With that said, if you do this, you then want to move your stop loss to the break even point.

The final thing that you don’t then want to do is to utilize a trailing stop loss. Using a trailing stop loss means that you can keep your risk in check even when you are making profits. This will allow you to keep making higher profits while keeping your losses to a minimum, or even to none at all. You definitely want to use a trailing stop loss.

The End of the Stock Market Correction

A market correction will usually end after about four months. However, that said, they can last longer, and it can get worse. What you are looking for here is a solution, and here you want to look at the price.

You want the stock index to break even and then to close above its all time high. If you see this occurring, the chances are pretty high that this particular stock market correction is over. You can then once again start allocating a higher percentage of your portfolio into a single trade.

Coming Out of a Stock Market Correction – The Bottom Line

If you follow all of the rules and tips that we have provided here today, you should have no problem coming out of the stock market correction on the other side in one piece.

CLICK ON IMAGE TO GET CRYPTO SIGNALS!

For more trading tips, strategies, methods, and everything in between, check out Andrew’s Trading Channel. Here you will find the world’s best stock market trading school, a trusted day trading school, state of the art indicators and trading tools, Forex and crypto signals groups, and more!

Leave a Reply